No products in the cart.

In the supply chain, there is much more to consider beyond the transportation of goods. Different types of warehouses might be more beneficial for specific goods. Often, goods are manufactured in China or other East Asian countries, and then sent to another country for assembly/storage, and sent elsewhere across the world. It stands to reason that a company would want to manufacture their goods in an area that would optimize the time needed to assemble and ship a product, with the most monetary benefits.

FTZ:

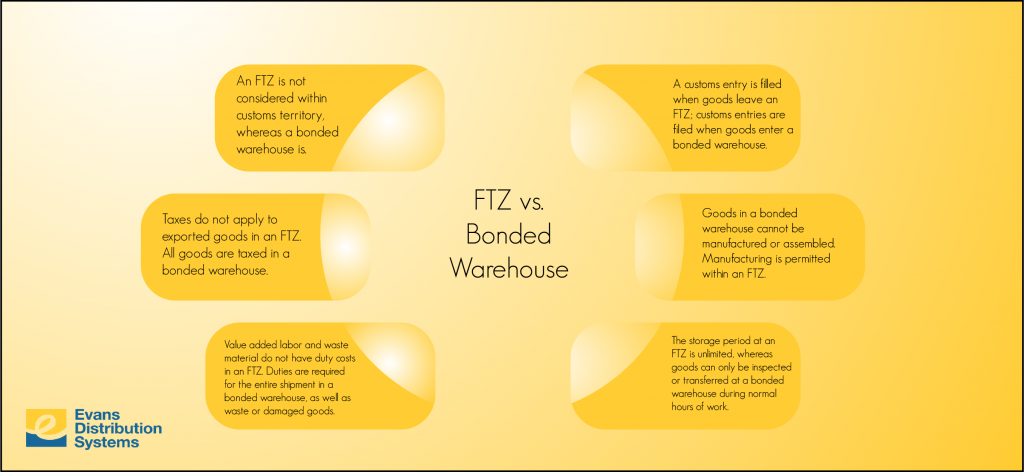

An FTZ is not considered within customs territory. An FTZ can transition goods for US import or transition them to a different country, without the need to enter US commerce. The movement of goods in and out of an FTZ is somewhat unlimited. Domestic goods do not need a customs permit to enter the warehouse, and domestic goods can be combined with foreign goods, such as in value added services. Goods in an FTZ warehouse can undergo value added procedures.

When goods are removed from an FTZ, a customs entry is filed. Payment of duty is only required when the goods leave the warehouse for consumption in the US. Customs bonds cover the admissions to the zone.

Taxes do not apply to foreign or domestic goods that will be exported. Both foreign and domestic goods can enter the FTZ. Duty rates are applied to the lowest rate of imported goods or the finished product. Tariff rates are also determined upon entry to the warehouse, or when goods are exited.

Manufacturing is permitted within an FTZ. Value added labor and waste material do not have duty costs. Duty is applied as the lowest rate of the finished value added product, or the imported components.

The FTZ has primary control of goods, 24 hours a day. The storage period is unlimited. Goods are also allowed to be destroyed, cleaned, sorted, labeled, assembled, repacked and sold.

Bonded warehouse:

Only foreign goods may enter a bonded warehouse, which is considered within customs territory. Bonded warehouses require usual customs, duties, tariffs, and duties costs. All goods are also taxed. Domestic goods are not permitted to enter the bonded warehouse.

Goods in a bonded warehouse cannot be assembled or manufactured. Customs permission is required for cleaning, sorting, and repackaging of goods. Duties are required for the entire shipment, as well as for waste or damaged goods.

Limited amount of withdrawals from a bonded warehouse. Also, the flow of goods is limited, as approval from customs is necessary for all shifts of goods.

Customs entries are filed when goods enter a bonded warehouse. A bonded warehouse requires customs bonds for all warehouse entries. Customs also possesses primary control of goods, which can only be inspected or transferred during typical hours of work. The storage period also cannot exceed 5 years. The value of the goods, as well as the tariff rates, are also decided immediately upon entry to a bonded warehouse. There is no manufacturing allowed in a bonded warehouse, so various products cannot be kitted and redistributed through value added services.

While an FTZ might be more beneficial for certain operations, a bonded warehouse has benefits as well. It may seem as though there are many restrictions on a bonded warehouse, but an FTZ isn’t necessarily beneficial for companies looking to sell goods domestically. An FTZ makes more sense for the foreign exportation of goods.

Here at Evans, we have three FTZs within the state of Michigan, as well as three bonded warehouses. These warehouse types that allows for benefits within the domestic space, as well as foreign exportation. Get in touch if you’d like to learn more about our types of warehouses, and how we can help you.

Great blog! Very good information!